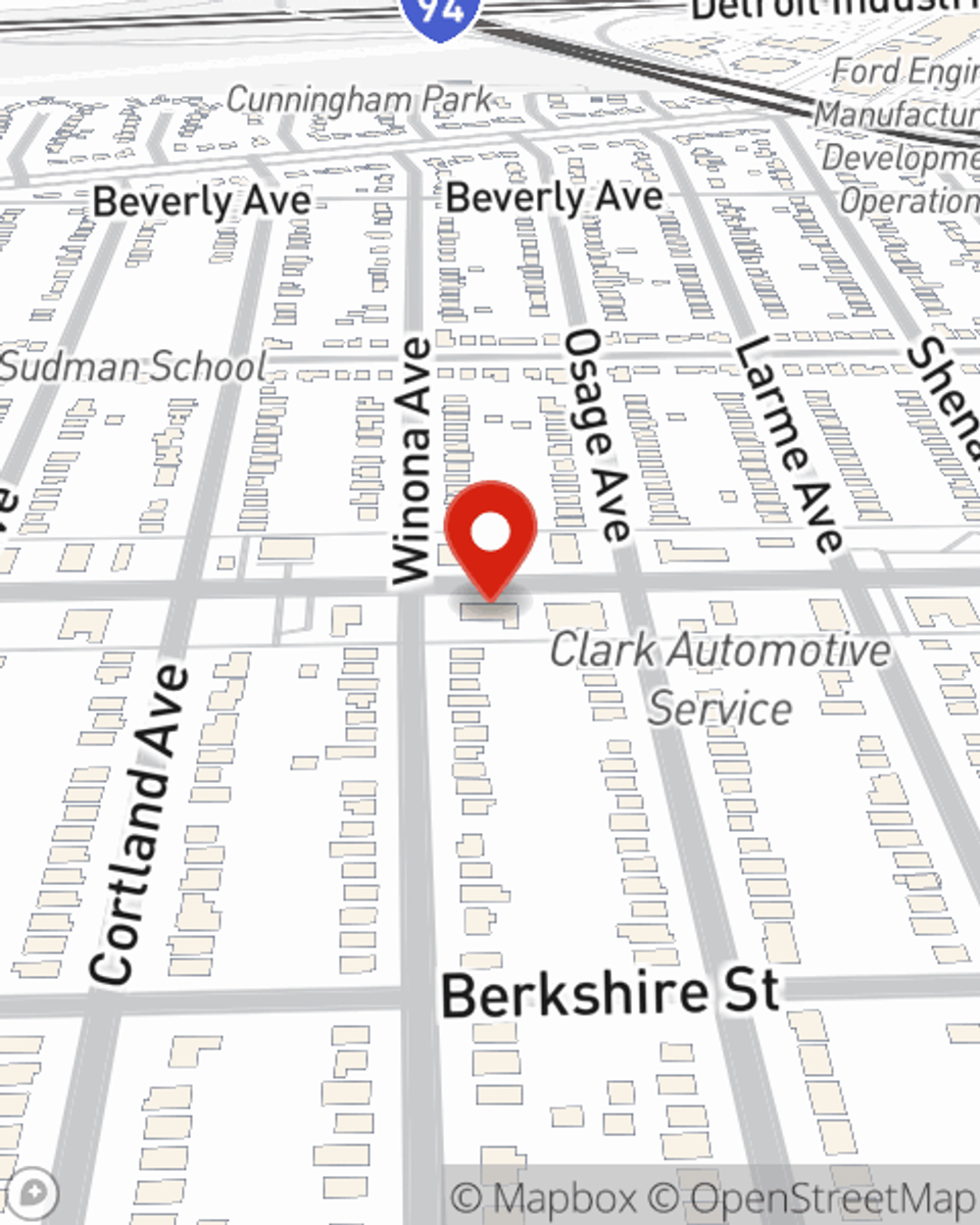

Business Insurance in and around Allen Park

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including extra liability coverage, business continuity plans and a surety or fidelity bond, among others.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Protect Your Future With State Farm

Your company is special. It's where you make your living and also how you grow your life—for yourself but also for your loved ones, and those who work for you. It’s more than just an office or earning a paycheck. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers a plethora of occupations like a pet groomer. State Farm agent Justin Listman is ready to help review coverages that fit your business needs. Whether you are a piano tuner, a podiatrist or a painter, or your business is a pottery shop, a janitorial service or a vet hospital. Whatever your do, your State Farm agent can help because our agents are business owners too! Justin Listman understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call or email agent Justin Listman to explore your small business coverage options today.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Justin Listman

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.